Luxury at what age can you draw social security

Table of Contents

Table of Contents

Are you considering retiring early and wondering how to draw social security early? If so, you are not alone. Many people want to retire early, but are unsure of the best way to access their social security benefits. In this blog post, we will discuss the steps you can take to draw social security early, as well as the benefits and drawbacks of doing so.

Pain Points

Approaching retirement age can be a daunting prospect, especially if you haven’t planned for it. You may be concerned about not having enough money to cover your expenses, or worried about the impact of inflation on your savings. Additionally, you may be unsure of how to access your social security benefits or when to begin taking them.

Answer to How To Draw Social Security Early

If you want to draw social security early, there are several steps you need to take. The first is to determine when you are eligible to begin receiving benefits. In most cases, you can start collecting social security benefits at age 62. However, keep in mind that taking benefits early will result in a reduced monthly payment. If you wait until your full retirement age (which varies depending on your date of birth), you can receive your full benefit amount.

Once you have determined when you can begin taking benefits, you can apply online at the Social Security Administration website, by phone, or in person. You will need to provide certain documents to prove your identity, such as a birth certificate or passport, and also provide information about your work history and earnings.

Summary of Main Points

Overall, drawing social security early can be an effective way to supplement your retirement income. However, it is important to carefully consider the impact it will have on your monthly benefit amount, as well as your overall retirement strategy. To draw social security early, you will need to determine your eligibility, provide the necessary documentation, and apply through the Social Security Administration.

Personal Experience with How to Draw Social Security Early

I recently helped my mother navigate the process of drawing social security early. She was concerned about having enough money to cover her expenses and wanted to begin receiving benefits as soon as possible. Together, we researched her eligibility requirements and gathered the necessary documents to apply. While she was initially disappointed with the reduced monthly payment amount, we were able to review her overall retirement strategy to find ways to supplement her income and ensure that her long-term financial needs were met.

Benefits and Drawbacks of Drawing Social Security Early

Benefits and Drawbacks of Drawing Social Security Early

One of the primary benefits of drawing social security early is that it can provide you with additional income when you need it most. This can help you cover your expenses and maintain your standard of living. However, there are also drawbacks to consider. First, taking benefits early will result in a reduced monthly payment, which can have a significant impact on your long-term financial security. Additionally, if you continue working while receiving social security benefits, your benefits may be reduced or withheld entirely.

In order to mitigate these drawbacks, it is important to carefully consider your overall retirement strategy and weigh the costs and benefits of taking benefits early versus waiting until your full retirement age.

Exploring the Impact of Early Social Security on Retirement

While drawing social security benefits early can be an effective way to supplement your income, it is important to consider the impact it will have on your overall retirement plan. Taking benefits early can result in a reduced monthly payment, which means you may need to find other sources of income to cover your expenses. Additionally, if you continue working while receiving social security benefits, your benefits may be reduced or withheld entirely.

To ensure that you are making the best decisions about when and how to draw social security early, it is recommended that you work with a retirement planner or financial advisor. These professionals can help you evaluate your options and make informed decisions about how to manage your retirement income.

When to Start Taking Social Security Benefits

One common question about how to draw social security early is when to start taking benefits. The answer depends on your specific financial situation and retirement goals. If you need additional income to cover your expenses, taking benefits early can be a good option. However, if you can wait until your full retirement age, you will receive a higher monthly benefit amount. Ultimately, the decision about when to take social security benefits will depend on your individual needs and priorities.

Question and Answer

Q: Can I draw early social security retirement and disability at the same time?

A: It is possible to draw both early social security retirement and disability benefits at the same time. However, keep in mind that taking early retirement benefits will result in a reduced monthly payment, which may impact the total amount of benefits you receive.

Q: Will my social security benefits be reduced if I continue working while receiving benefits?

A: If you work while receiving social security benefits before your full retirement age, your benefits may be reduced or withheld entirely. After your full retirement age, you can work and receive benefits without any impact on your monthly payment amount.

Q: How much can I expect to receive in social security benefits if I draw early?

A: The amount of social security benefits you receive will depend on several factors, including your lifetime earnings, your age when you begin taking benefits, and your retirement age. Taking benefits early will result in a reduced monthly payment amount.

Q: Can I change my mind about when to start taking social security benefits?

A: It is possible to change your mind about when to start taking social security benefits. However, keep in mind that once you start receiving benefits, you may not be able to change your mind and suspend payments.

Conclusion of How to Draw Social Security Early

Drawing social security benefits early can be an effective way to supplement your retirement income, but it is important to carefully consider the impact it will have on your financial security. By working with a retirement planner or financial advisor, you can make informed decisions about when and how to access your benefits, and ensure that your long-term needs are met.

Gallery

5 Reasons To Draw Social Security Early | MoneyTips

Photo Credit by: bing.com / security social reasons draw early moneytips

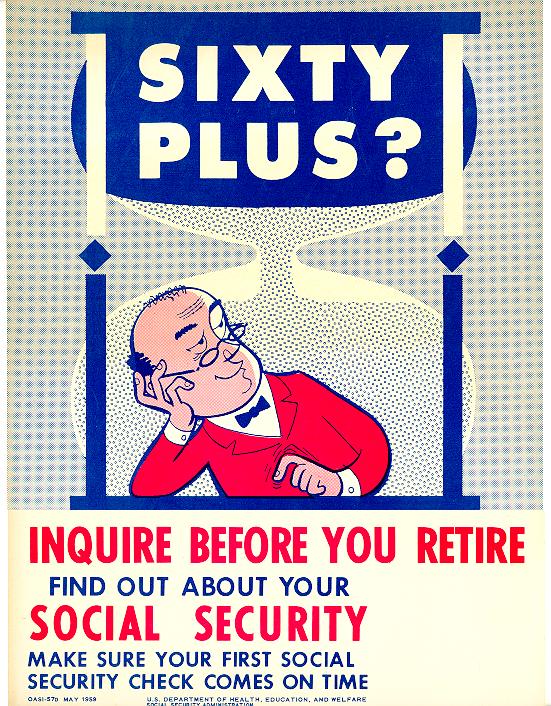

Can I Draw Early Social Security Retirement And Disability At The Same

Photo Credit by: bing.com / security social retirement poster ssa 1959 early history draw generations promise administration old choose board men gov sixty plus

Luxury At What Age Can You Draw Social Security | Social Security

Photo Credit by: bing.com /

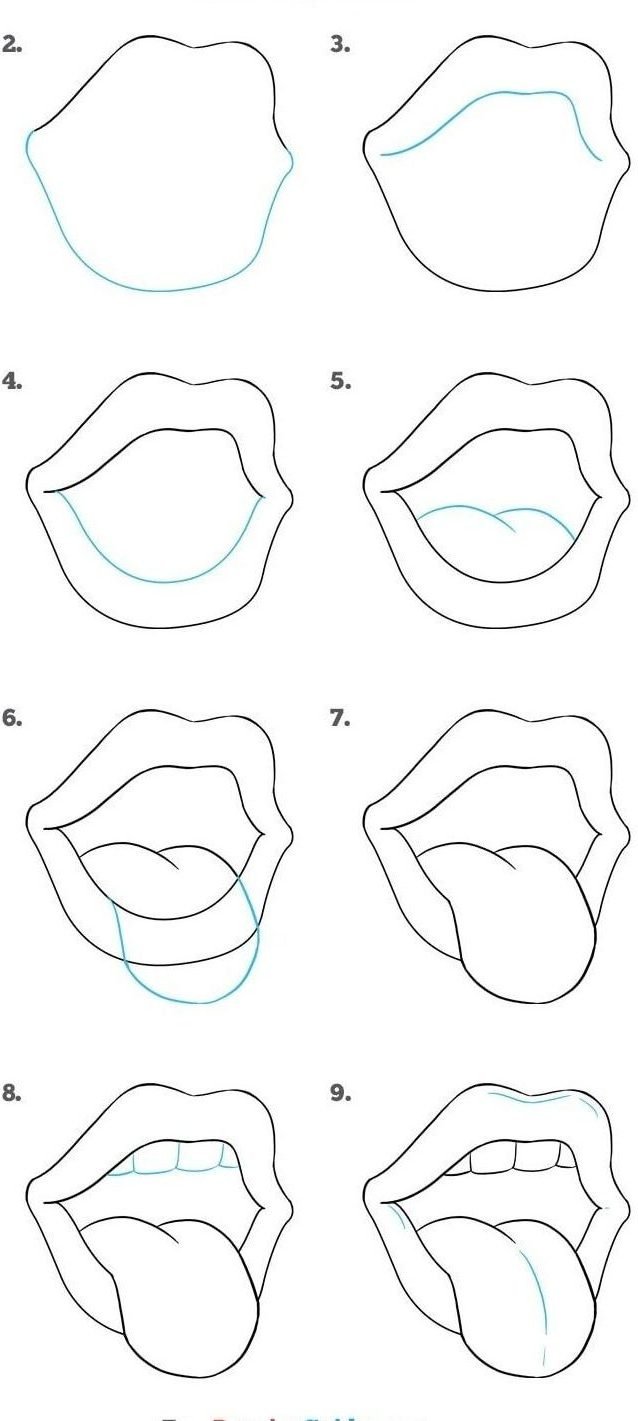

To Draw Or Not To Draw: Early Social Security Benefits

Photo Credit by: bing.com / draw security social drawing benefits early much

Should Baby Boomers Draw Social Security At 62? - Retirement Planning

Photo Credit by: bing.com / security social draw should boomers baby site